How Contractor Labor Tax Evasion Affects Us All

Contractor labor tax evasion is a pervasive issue that often goes unnoticed but has far-reaching consequences for society as a whole. When contractors evade taxes, they not only cheat the government out of revenue, but they also create an unfair playing field for businesses that operate ethically and pay their fair share. This article aims to shed light on the hidden costs of contractor labor tax evasion and highlight the need for collective action to combat this problem, Many contractor laborer’s that are unloading or loading trucks are either paying there full tax share or in most cases not claiming but small portion of there earned income or not filing all together, Many contract labor have gotten greedy on how much they chare to unload or load trucks.

The impact of contractor labor tax evasion extends beyond just the government’s coffers. It affects everyone, from workers who may be exploited and underpaid, to businesses that struggle to compete with those who evade taxes. By understanding the nature of this issue and its implications, we can work towards creating a fairer and more equitable society.

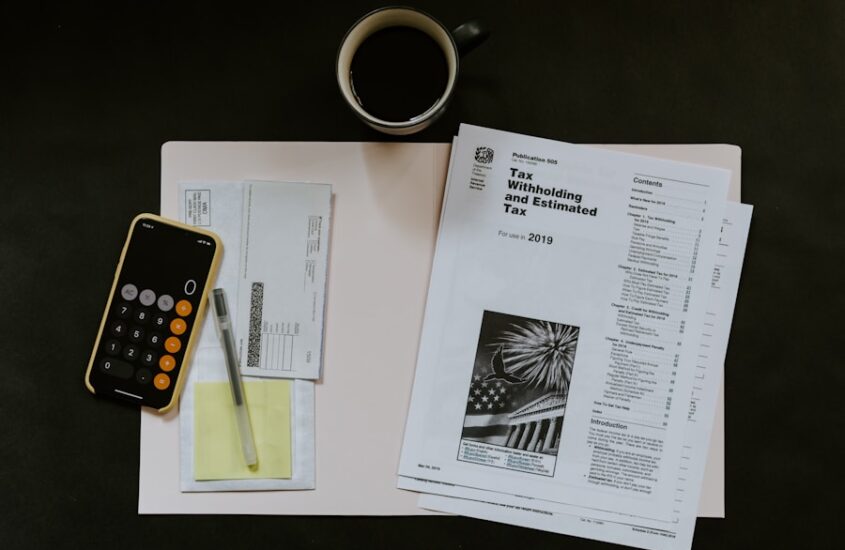

What is Contractor Labor Tax Evasion?

Contractor labor tax evasion refers to the deliberate act of contractors avoiding or underreporting their income to evade paying taxes. This can be done through various means, such as misclassifying employees as independent contractors, underreporting income, or engaging in cash transactions to avoid a paper trail. By doing so, contractors are able to reduce their tax liability and keep more money in their pockets.

Examples of contractor labor tax evasion are prevalent in industries such as construction, hospitality, Moving and transportation. For instance, a construction company may misclassify its workers as independent contractors to avoid paying payroll taxes and providing benefits. Similarly, a restaurant owner may underreport cash sales to reduce their taxable income. These practices not only harm the government’s revenue but also create an unfair advantage for those who engage in tax evasion. The impact of contractor labor tax evasion on the economy cannot be understated. When contractors evade taxes, it leads to a significant loss of revenue for the government. This loss directly affects the funding available for public services, infrastructure development, and social welfare programs. As a result, the burden of financing these essential services falls on law-abiding citizens and businesses.

According to a study conducted by the IRS, the tax gap, which includes both legal and illegal tax avoidance, was estimated to be around $441 billion in 2019. This staggering amount represents the difference between what taxpayers owe and what they actually pay. Contractor labor tax evasion contributes significantly to this tax gap, depriving the government of much-needed revenue.

Furthermore, contractor labor tax evasion distorts competition within industries. Businesses that engage in tax evasion can offer lower prices for their goods or services since they do not have to factor in the costs associated with paying taxes. This puts businesses that operate ethically at a disadvantage, as they are unable to compete on price. Consequently, this unfair competition can lead to market consolidation and hinder the growth of small and medium-sized enterprises.

Contractor labor tax evasion not only affects workers but also has significant consequences for businesses that operate ethically. When some businesses evade taxes, they gain an unfair advantage over their competitors who pay their fair share. This can lead to a loss of market share and profitability for law-abiding businesses, ultimately hindering economic growth.

Additionally, businesses that engage in tax evasion may undercut their competitors’ prices, making it difficult for ethical businesses to compete. This can result in a race to the bottom, where businesses are forced to lower their prices to remain competitive, often at the expense of fair wages and quality products or services. Ultimately, this erodes trust in the marketplace and undermines the integrity of the business environment.

Furthermore, contractor labor tax evasion can strain relationships between businesses and their contractors. When contractors evade taxes, they may face legal consequences or audits from tax authorities. This can disrupt ongoing projects or partnerships, leading to delays and additional costs for businesses that rely on these contractors. The reputational damage caused by association with tax-evading contractors can also harm a business’s brand image and customer trust, contractor labor should be controlled through trucking companies so that laborers do not over charge the independent contractor and they are forced to pay taxes, because almost all trucking companies do not or have not increased their rate to offset labor cost.

overall these individuals that avoid paying any taxes effect the standard employee wages and the overall well being of the economy